Denver, CO Dispensary Investment

LANDSCAPE

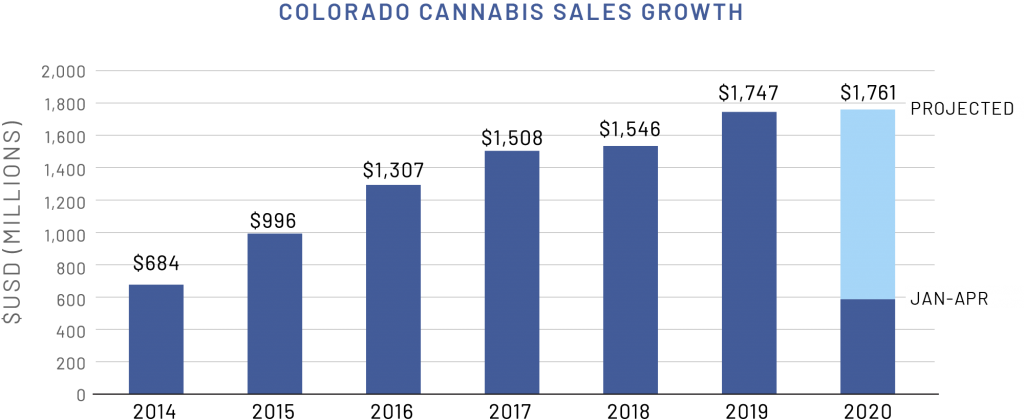

Since the inception of legalized cannabis in Colorado in 2014, the industry has seen sustained growth that is set to continue throughout the next decade. The Colorado cannabis market is on track to approach $2 billion this year alone. Forbes has estimated that by 2025, the marijuana market in the US could reach $30 Billion, which is a large increase from $10 Billion in 2018.

At Rittertime, we do not have a crystal ball, so it is impossible to know when the federal prohibition of cannabis will end. Currently, the most skilled and experienced operators are using private capital as an alternate form of financing and they see the current market as an opportunity. The brands that will capitalize on future growth are expanding today.

THE DISPENSARY

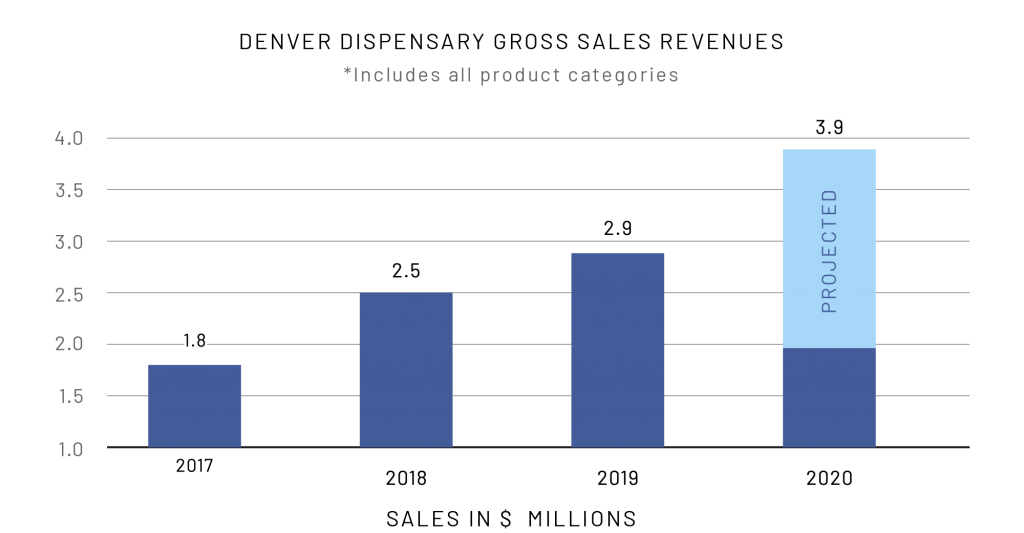

Denver Dispensary is a Cannabis Dispensary and Cultivation Facility in Denver, Colorado founded in 2010. Years of experience at the top of the industry, plus proven sales history, makes Denver Dispensary an ideal candidate for passive investors who utilize commercial real estate as their vehicle to be involved in the legal cannabis industry. They have increased gross profits every year since opening in 2011, and are currently funding their expansion into a new cultivation facility and modern retail center in order to combat tax code 280e and increase profitability.

INVESTMENT OVERVIEW

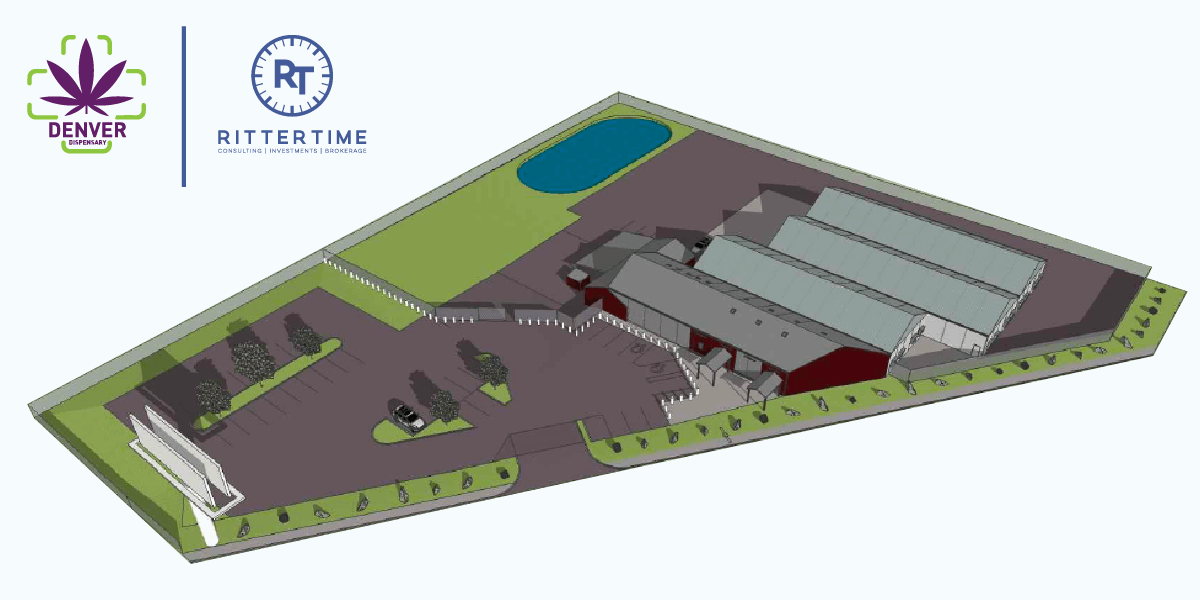

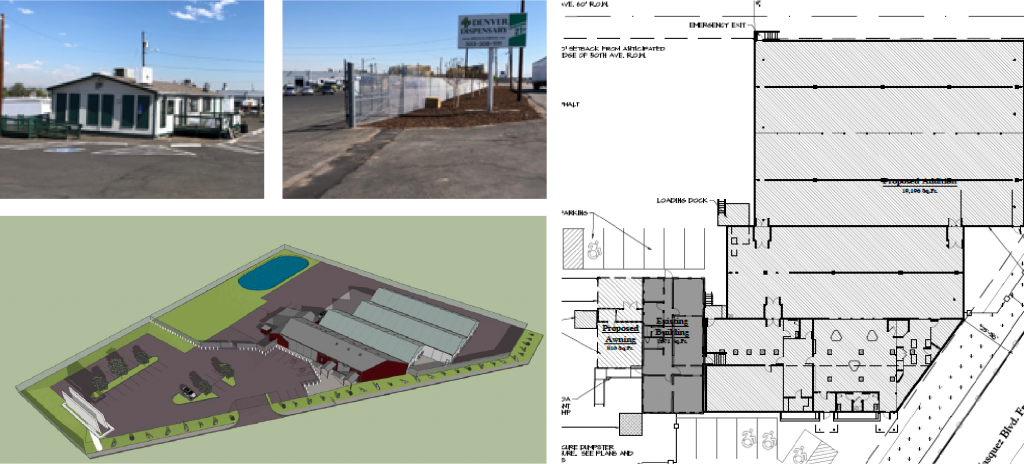

The property owners have invested in architecture and engineering plans that are currently in review with the city of Denver and will be ready for 2020 construction.

Key Points:

- The expansion will cover almost 20,000 additional square feet combining a new retail center and greenhouse for cultivation

- Includes a new retail center and greenhouse for cultivation

- The greenhouse will produce approximately 5,000 pounds of product annually

- The greenhouse expansion alone set to increase revenue by $4.5M

SPECIFICS

| Property valuation: | $1,000,000.00 in 2015 (as appraised) |

| Property mortgage/loans: | $0 |

| Loan amount: | $3,000,000 |

| Loan Proceeds: | Construction of approximately 20,000 square foot cultivation greenhouse and retail store |

| Value after improvements: | $6,000,000 + |

| Future Lease: | Current tenant will sign a lease at $25/sq. ft. NNN |

| Duration: | 15 years |

* Owner is open to JV & additional investment vehicles

DENVER DISPENSARY HIGHLIGHTS

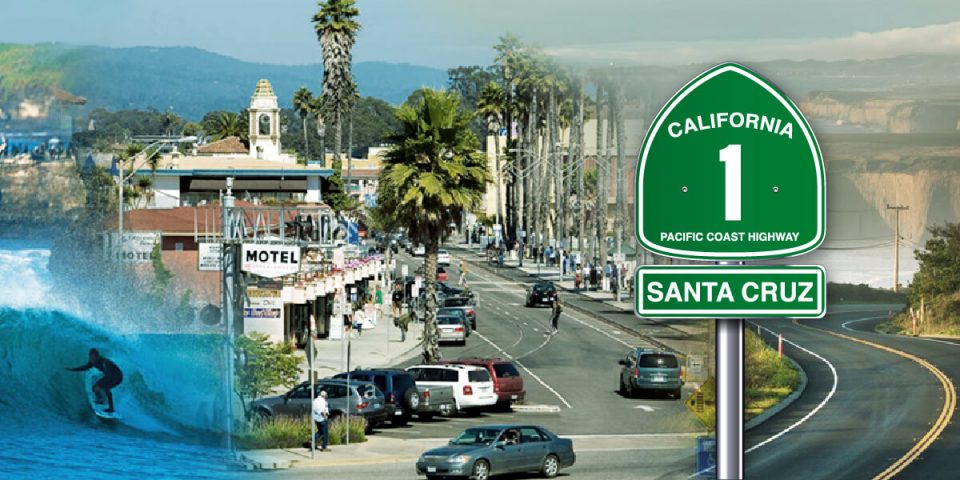

Denver Dispensary has operated a dispensary and cultivation facility in Colorado since 2011 and they are having a record year as of June 2020. They own their ‘centrally located’ real estate free and clear and would consider an equity partner or a ground-up construction loan.

Their sales performance, knowledge, and background of cultivation positions them to successfully expand their MED/REC OPC TEIR 1 license to TEIR 2 to be fully integrated and continue increasing profits by wholesaling to other dispensaries.

- Denver Dispensary’s retail location currently generates almost $3M a year in revenue (about $2M is flower/trim)

- June 2020 gross sales revenue is up $300,000 (compared to June 2019)

- They have thrived in an industry that grew from infancy, one that is highly scrutinized and extremely regulated

Are you an investor that is looking to diversify into a burgeoning field at the right time? We would like to speak with debt and/or equity investors, family offices or accredited investors who believe in legal cannabis and are looking for double digit returns on their investments.

We take the time to educate interested investors about the various facets of cannabis investing, including our exclusive Denver Dispensary opportunity. Very few businesses offer this type of partnership and having access to this type of deal at such an early time is rare.

It will be worth your time to provide us with basic information, including what you are looking for, and we will be in touch!