Real Estate Fund – Investment Opportunity

OVERVIEW

Rittertime has just entered into a partnership with a $50m Req. D net-leased real estate investment fund. The offering has been created to alleviate the primary challenges associated with investing in the cannabis sector while capitalizing on the Green Rush returns. The Fund intends to provide its limited partners with an attractive yet stable way to participate in the developing cannabis net-leased real estate sector and capital markets. The fund managers are operator centric and have extensive experience and developed relationships in the cannabis industry that will provide diversified deal-flow across all real estate sectors including cultivation, extraction, manufacturing, laboratory testing, packaging, distribution and retail. It is important to note that this fund does not touch or invest in the cannabis flower.

OFFERING HIGHLIGHTS

| Structure: | Regulation D |

| Offering Amount: | $50,000,000 |

| Investment Minimum: | $25,000 |

| Anticipated Pref Return: | 8% (annualized, cash-on-cash) |

| Distribution Frequency | Monthly |

| Waterfall: | 75% LP / 25% GP After LP receives 15% annual cumulative return, 50% LP / 50% GP |

| Anticipated Hold: | 5 years |

| Investor Suitability: | Accredited investors |

OFFERING HIGHLIGHTS

Potential Benefits:

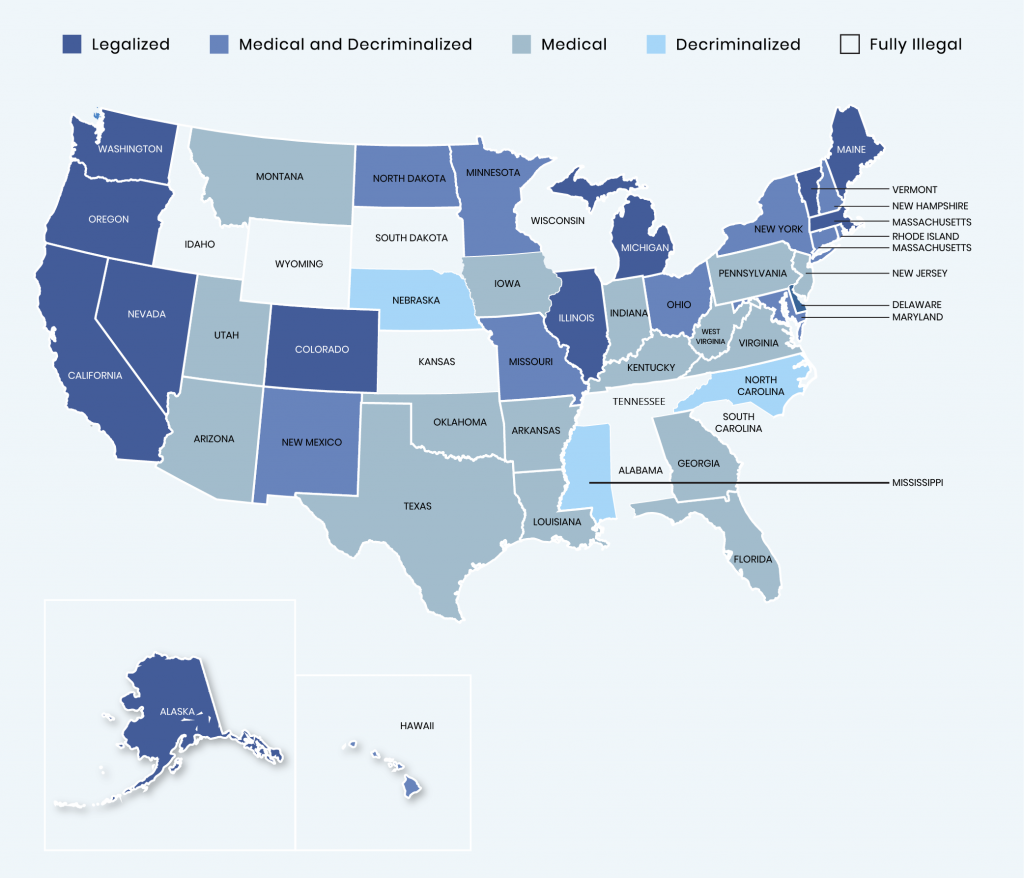

- Real Estate-backed exposure to the cannabis Industry NN and NNN Leases in legal, regulated state markets across the United States

- Preserve the Limited Partners’ capital investment

- Realize income through the acquisition, property rents, operation and sale of the Investments

- Monthly distributions to the Limited Partners from cash generated by operations

- Protect against inflation

- Partnership is a ‘flow through entity”, providing certain tax benefits to the LPs investors1

- Maximize total return through income and realized appreciation

WHY NOW

The cannabis industry continues to receive U.S. state approval for medical and recreational access boosting the size of the legal cannabis retail market. However, due to the continuing unsettled federal regulations and lack of access to capital markets, asset prices are favorable across the cannabis industry. In addition, many Operators are having a difficult time accessing the capital markets through traditional channels. We believe the current market fundamentals are a good time to lock in the risk premium associated with cannabis.

WANT TO KNOW MORE?

We are very excited about this opportunity and the wheels are in motion, we would love to take a minute and explain, in person all of the ins and outs of this investment opportunity. Please take a minute to fill out some basic information and we will get in touch!

To be considered an accredited investor, an individual must (a) have income of at least $200,000 (or $300,000 together with a spouse) in each of the prior two years and “reasonably expects the same for the current year,”, (b) have a net worth, exclusive of primary residents of at least $1,000,000 either alone or together with a spouse or (c) an entity with assets in excess of $5,000,000 that has not been created with the sole purpose of purchasing securities.